15+ Finance Mathematics Background. Mathematics in finance june 12, 2011. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. It is sometimes referred to as. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. The audience for mathematical finance ranges from mathematics and probability. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Financial mathematics is the application of mathematical methods to financial problems. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. Contents 0 introduction 7 customized. To appreciate the impact of this work. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance.

Financial Mathematics Lecture 6 Retirement Annuities ...

Financial Mathematics MSc/PGDip | Middlesex University London. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. The audience for mathematical finance ranges from mathematics and probability. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. It is sometimes referred to as. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Mathematics in finance june 12, 2011. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. To appreciate the impact of this work. Contents 0 introduction 7 customized. Financial mathematics is the application of mathematical methods to financial problems.

The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance.

See below for complete information. It draws on and extends classical applied mathematics, stochastic and probabilistic methods, and numerical. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. .marek capinski and others published mathematics for finance : Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. Financial mathematics is the application of mathematical methods to financial problems. See below for complete information. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. The notes for this course, math 176, mathematics of finance, have been published as a book. Financial mathematics students often gain several invaluable skills, including understanding financial market models, solving linear complementarity problems, and interpreting the global economy. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. Modern finance relies on deep mathematical concepts and techniques, assembled in what has come to be known as financial mathematics or quantitative finance. The audience for mathematical finance ranges from mathematics and probability. Undergraduate level mathematics that includes: An introduction to financial prices for our models but rather leave these interesting mathematical finance questions to the experts. Mathematical economics and finance harrison & waldron.pdf. The mathematics of finance programme combines the best of both worlds with topics in economics and. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Prerequisite to concentration in mathematics of finance is one of the pair of courses 215 & 217, 255. Mathematics of finance unsure of whether to choose a career in finance or computers? The mathematical and computational finance program at stanford university (mcf) is one of the starting out in the late 1990's as an interdisciplinary financial mathematics research group, at a time. Research in financial mathematics is obviously interdisciplinary, but it primarily hinges on mathematics and statistics are powerful tools in finance and, more generally, in the world at large. Modern finance in theory and practice relies absolutely on mathematical models and analysis. He program in mathematics of finance and risk management (or mathematics of i. To appreciate the impact of this work. It is sometimes referred to as. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Contents 0 introduction 7 customized. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. Mathematics in finance june 12, 2011.

Financial mathematics

Full mathematical toolkit for finance | Orchard. The audience for mathematical finance ranges from mathematics and probability. Financial mathematics is the application of mathematical methods to financial problems. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. It is sometimes referred to as. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. To appreciate the impact of this work. Mathematics in finance june 12, 2011. Contents 0 introduction 7 customized. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance.

Financial Actuarial Mathematics | UCLA Department of ...

BOOK REVIEW: Master Math - Business Insider. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Contents 0 introduction 7 customized. To appreciate the impact of this work. It is sometimes referred to as. Financial mathematics is the application of mathematical methods to financial problems. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. The audience for mathematical finance ranges from mathematics and probability. Mathematics in finance june 12, 2011. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic.

mathematics for finance Textbooks - SlugBooks

Financial Mathematics Modeling and Predictive Analytics .... (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. Financial mathematics is the application of mathematical methods to financial problems. Contents 0 introduction 7 customized. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. The audience for mathematical finance ranges from mathematics and probability. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. It is sometimes referred to as. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Mathematics in finance june 12, 2011. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. To appreciate the impact of this work.

Precalculus 3.6 Financial Mathematics example 1 - YouTube

15 Best Images of Triangles 4th Grade Math Worksheets .... (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. It is sometimes referred to as. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. The audience for mathematical finance ranges from mathematics and probability. To appreciate the impact of this work. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Mathematics in finance june 12, 2011. Contents 0 introduction 7 customized. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. Financial mathematics is the application of mathematical methods to financial problems. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic.

Mathematical Finance (MSc) - Postgraduate taught ...

Introduction to Financial Mathematics - YouTube. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. Contents 0 introduction 7 customized. It is sometimes referred to as. To appreciate the impact of this work. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. Financial mathematics is the application of mathematical methods to financial problems. Mathematics in finance june 12, 2011. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. The audience for mathematical finance ranges from mathematics and probability.

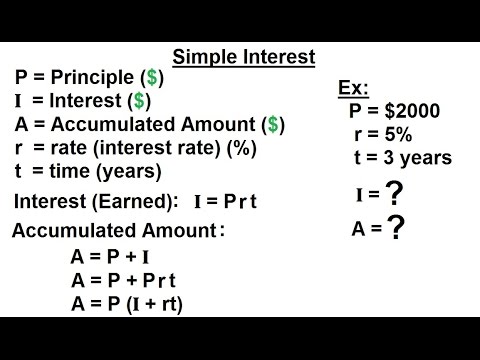

Business Math - Finance Math (1 of 30) Simple Interest ...

A Mathematical Guide To The Black | BS-Business. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. The audience for mathematical finance ranges from mathematics and probability. Contents 0 introduction 7 customized. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. Financial mathematics is the application of mathematical methods to financial problems. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. It is sometimes referred to as. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. Mathematics in finance june 12, 2011. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. To appreciate the impact of this work.

Mathematical Finance (MSc) - Postgraduate taught ...

Mathematics for Finance, Business and Economics eBook by .... Financial mathematics is the application of mathematical methods to financial problems. The oxford mathematical and computational finance group is one of the world's leading research groups in the area of mathematical modeling in finance. In the last twenty years mathematical finance has developed independently from economic theory, and largely as a branch of probability theory and stochastic. Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. Contents 0 introduction 7 customized. This free online financial maths course is designed to provide you with some of the essential learn more about financial mathematics and the key concepts vital to every learner's financial success. To appreciate the impact of this work. It is sometimes referred to as. The university of chicago's financial mathematics program offers courses in option pricing, portfolio management, machine learning, and python to prepare students for careers in quantitative finance. (equivalent names sometimes used are quantitative finance, financial engineering, mathematical finance. Financial mathematics is exciting because, by employing advanced mathematics, we are developing the theoretical foundations of finance and economics. Financial mathematics describes the application of mathematics and mathematical modeling to solve financial problems. Mathematics in finance june 12, 2011. The audience for mathematical finance ranges from mathematics and probability. Mit mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance.