37+ Are Finance Costs Operating Expenses PNG. The term finance cost is broader and also includes costs other than just interest expense. Finance costs are also known as financing costs and borrowing costs. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Its counterpart, a capital expenditure (capex). They are easily available in the income statement along with other costs which are. Operating expenses refer to expenditures that are not directly tied to the production of goods or. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. What is finance costs on income statement? Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Finance costs are also known as financing costs and borrowing costs. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. An operating expense is an expense a business incurs through its normal business operations.

Net income is gross profit less a financing expenses b ...

Riley & Associates: Understanding Financial Statements. Finance costs are also known as financing costs and borrowing costs. The term finance cost is broader and also includes costs other than just interest expense. What is finance costs on income statement? Its counterpart, a capital expenditure (capex). Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. An operating expense is an expense a business incurs through its normal business operations. Finance costs are also known as financing costs and borrowing costs. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. They are easily available in the income statement along with other costs which are. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Operating expenses refer to expenditures that are not directly tied to the production of goods or.

Operating expenses are the costs a business incurs as part of its regular business activities, not including the cost of goods sold.

Are you the type of owner who merely monitors business expenses and income without looking at detailed. Finance costs are also known as financing costs and borrowing costs. Operating expenses take away from the amount of cash a business has in its possession, so people in the finance industry look at this number to gain insight on things like how the business could improve cash flow. All funds spent when converting inventory into throughput falls under opex. Include expenses for services provided by vita computer operations personnel and other costs. They are easily available in the income statement along with other costs which are. Operating expenses, operating expenditures, or opex, refers to the expenses incurred regarding a business's operational activities. Thus, the lower a company's operating expenses are, the more profitable it generally is. This includes employee wages, repair and maintenance of equipment, rental fees, and utility bills and so on. They include everything from employee salaries to the toilet paper in the office restrooms; Operating expenses are the costs a business incurs as part of its regular business activities, not including the cost of goods sold. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. Are you the type of owner who merely monitors business expenses and income without looking at detailed. Its counterpart, a capital expenditure (capex). Sometimes the definition of operating expense may include the cost of goods sold as well. Over time, changes in the oer indicate whether the company can increase sales without increasing operating. Research and development to electricity bills; A rising oer may signal a decline in your business' operating efficiency from year to year, so you'll want to take a close look at your business operations to determine the cause. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Essentially, operating expenses are the costs of keeping the business running, beyond direct materials and labor. An operating expense is an expense a business incurs through its normal business operations. Numerous costs and expense are incurred in the operation (leasing) of a property. Operating expenses are costs associated with running a business's core operations on a daily basis. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. Operating activities, investing activities, and financing activities, the decision to. However, when cash flows are separated by: Operating expenses on an income statement are the costs that arise during the ordinary course of running a business. There are two main types: Operating expenses do not include cost of goods sold (materials, direct labor, manufacturing overhead) or capital expenditures (larger expenses such as buildings or machines). Other operating expenses, also known as overhead expenses, is the amount which generally does not depend on sales or production quantities. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement.

FREE 6+ Sample Budget Spreadsheets in PDF | Excel | MS Word

eFinanceManagement.com | Financial Management Concepts in .... Finance costs are also known as financing costs and borrowing costs. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. What is finance costs on income statement? An operating expense is an expense a business incurs through its normal business operations. Its counterpart, a capital expenditure (capex). They are easily available in the income statement along with other costs which are. The term finance cost is broader and also includes costs other than just interest expense. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. Operating expenses refer to expenditures that are not directly tied to the production of goods or. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Finance costs are also known as financing costs and borrowing costs. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations.

Expenses: Expenditure for operating costs of an accounting ...

USDA ERS - Documentation for the Farm Sector Financial Ratios. Its counterpart, a capital expenditure (capex). They are easily available in the income statement along with other costs which are. Finance costs are also known as financing costs and borrowing costs. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. An operating expense is an expense a business incurs through its normal business operations. Finance costs are also known as financing costs and borrowing costs. Operating expenses refer to expenditures that are not directly tied to the production of goods or. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. What is finance costs on income statement? The term finance cost is broader and also includes costs other than just interest expense. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations.

Measuring Financial Sustainability

SG&A Expense (Selling, General & Administrative) - Guide .... An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. The term finance cost is broader and also includes costs other than just interest expense. Finance costs are also known as financing costs and borrowing costs. They are easily available in the income statement along with other costs which are. An operating expense is an expense a business incurs through its normal business operations. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Its counterpart, a capital expenditure (capex). Finance costs are also known as financing costs and borrowing costs. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. Operating expenses refer to expenditures that are not directly tied to the production of goods or. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. What is finance costs on income statement?

Operating Expense (Definition, Formula) | Calculate OPEX

Financial Reporting: Creating Attractive Financial Statements. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. The term finance cost is broader and also includes costs other than just interest expense. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. Its counterpart, a capital expenditure (capex). Finance costs are also known as financing costs and borrowing costs. What is finance costs on income statement? An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. Operating expenses refer to expenditures that are not directly tied to the production of goods or. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. They are easily available in the income statement along with other costs which are. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. An operating expense is an expense a business incurs through its normal business operations. Finance costs are also known as financing costs and borrowing costs. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs.

Opening a gym: How to set your a budget - PFP media

Reveal The Best Ways Small Business Owners Can Reduce .... The term finance cost is broader and also includes costs other than just interest expense. Operating expenses refer to expenditures that are not directly tied to the production of goods or. An operating expense is an expense a business incurs through its normal business operations. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Its counterpart, a capital expenditure (capex). They are easily available in the income statement along with other costs which are. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. What is finance costs on income statement? Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. Finance costs are also known as financing costs and borrowing costs. Finance costs are also known as financing costs and borrowing costs. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery.

Reveal The Best Ways Small Business Owners Can Reduce ...

Financial statement preparation. An operating expense is an expense a business incurs through its normal business operations. Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Operating expenses refer to expenditures that are not directly tied to the production of goods or. Finance costs are also known as financing costs and borrowing costs. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. Finance costs are also known as financing costs and borrowing costs. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services. The term finance cost is broader and also includes costs other than just interest expense. Its counterpart, a capital expenditure (capex). Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. They are easily available in the income statement along with other costs which are. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. What is finance costs on income statement?

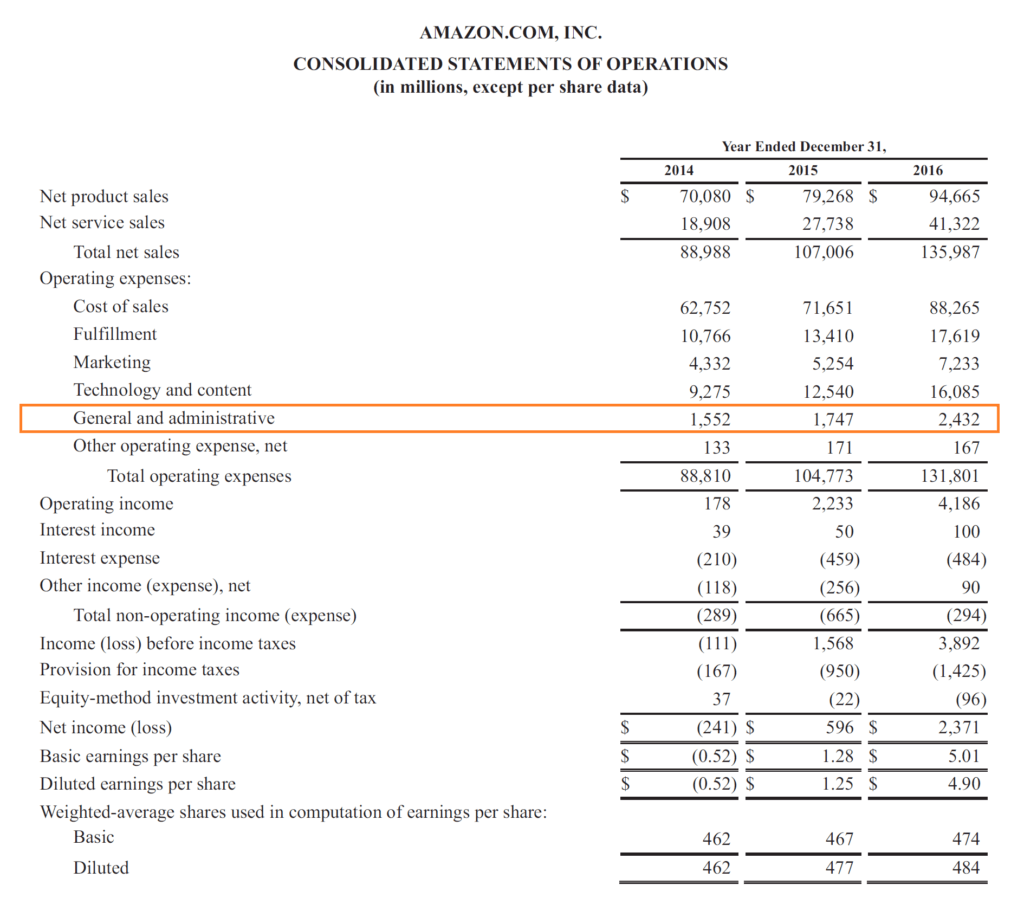

How to Evaluate an Income Statement as an Effective ...

How to Evaluate an Income Statement as an Effective .... Operating expenses (opex) and cost of goods sold (cogs) are separate sets of expenditures incurred by businesses in running their daily operations. Definition of operating expenses operating expenses are the costs that have been used up (expired) as part of a company's main operating activities during the period shown in the heading of its income statement. What is finance costs on income statement? Finance costs are also known as financing costs and borrowing costs. Operating expense (opex) is the cost that is incurred in the normal course of business and does not include expenses such as the cost of goods sold which are directly related to product manufacturing or service delivery. Finance costs are also known as financing costs and borrowing costs. An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system. The term finance cost is broader and also includes costs other than just interest expense. An operating expense is an expense a business incurs through its normal business operations. Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. They are easily available in the income statement along with other costs which are. Companies finance their operations either through equity financing or finance costs are usually understood to be referred to interest costs. Its counterpart, a capital expenditure (capex). Operating expenses refer to expenditures that are not directly tied to the production of goods or. Operating expenses are those expenditures that a business incurs to engage in activities not directly associated with the production of goods or services.