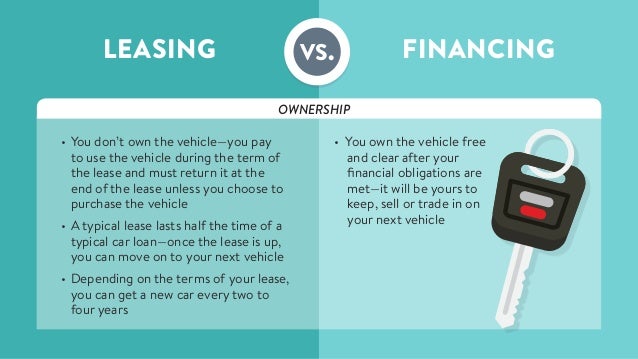

Download Finance Versus Lease Car Pics. Insurance coverages required by your lease holder. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. There are several distinct advantages to leasing versus buying. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. Comparing the two major finance choices. The contract discourages any customization. What are the benefits of leasing a car? Car buyers have two financing options when it comes time to purchase a new car. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. Leasing a car isn't for everyone. The company that finances your leased car owns it. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. Consumer reports examines the basic differences: To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and.

Leasing vs Financing: How It Affect Auto Insurance - Auto ...

Leasing vs. Buying a Car with Bad Credit (Pros & Cons). Car buyers have two financing options when it comes time to purchase a new car. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. Comparing the two major finance choices. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. Insurance coverages required by your lease holder. The contract discourages any customization. The company that finances your leased car owns it. Consumer reports examines the basic differences: Leasing a car isn't for everyone. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. What are the benefits of leasing a car? There are several distinct advantages to leasing versus buying. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years.

Just hand the keys over to the dealer and get a.

In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. And unlike other online auto lease calculators, this calculator will generate a lease versus buy car analysis for the number of years you expect to. When leasing a new car, you're essentially paying for the vehicle's depreciation, with the car's value falling by as much as 60% in the first few years. There are advantages and disadvantages to both options. Assuming you're comparing leasing versus financing a purchase of the same car, the lease payments will generally be lower than the monthly loan payments. Saving for a down payment or trading in a car can reduce the amount you need to finance or lease, which then lowers your financing or leasing costs. The contract discourages any customization. Car leasing vs financing in canada doesn't have to be hard. Though the decision to lease or buy a car has financial implications—money isn't the only factor you should take into consideration before you pull the trigger on a deal. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. The most obvious difference is that with a lease, you get a new car every few years and don't have to deal with the hassle of selling the car later; A car lease is a contract in which one party permits another party to a vehicle for a specified period of time in exchange for periodic payments, usually the difference between leasing a car and financing a car is that with financing, you are purchasing the vehicle. Is leasing a car better than financing? Comparing the two major finance choices. Monthly payments are applied to depreciation, not the purchase price of the vehicle. It is better in all categories except when you have to drive a lot. You sign a contract for a fixed price over a fixed period of time, usually between 24 and 36 months, with a fixed mileage. Not only these, but operating lease versus capital lease also differ in whether a purchase option is present, and the length of the lease term. How is leasing different from financing? Both leasing and buying have advantages and disadvantages, just like renting versus buying a house. When the lease is over, you return the car to the. Buying a vehicle means you maintain. Some people need to see the numbers, so we. Take your time, and weigh all of the advantages and disadvantages of. First, leasing is only an option for financing brand new cars, not used cars, although leasing of used luxury cars is available from specialty car dealers in some cities. Odds are a lease can be approved with a simple application, some bank what works for other car care business owners might not be the best option for you. This is the question everyone is faced with when it comes time to shop for a new ride. You may be able to afford a brand new car, complete with. Financing a car versus leasing a car?

Financing and Leasing Information | Campbell River Toyota

Buying Versus Leasing A Vehicle - Flagstone Financial. Comparing the two major finance choices. Car buyers have two financing options when it comes time to purchase a new car. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. What are the benefits of leasing a car? The contract discourages any customization. There are several distinct advantages to leasing versus buying. Leasing a car isn't for everyone. The company that finances your leased car owns it. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. Insurance coverages required by your lease holder. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. Consumer reports examines the basic differences: Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan.

Is It Better To Buy Or Lease A Car?

Types of Lease Financing | Finance Lease vs Operating Lease. What are the benefits of leasing a car? There are several distinct advantages to leasing versus buying. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. Consumer reports examines the basic differences: The company that finances your leased car owns it. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. Insurance coverages required by your lease holder. Leasing a car isn't for everyone. Comparing the two major finance choices. Car buyers have two financing options when it comes time to purchase a new car. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. The contract discourages any customization.

Car Lease vs Buy Calculator

Lease VS Finance | Bolton Honda. Leasing a car isn't for everyone. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. The contract discourages any customization. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. Insurance coverages required by your lease holder. What are the benefits of leasing a car? The company that finances your leased car owns it. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. There are several distinct advantages to leasing versus buying. Consumer reports examines the basic differences: Car buyers have two financing options when it comes time to purchase a new car. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. Comparing the two major finance choices. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and.

Buying vs leasing a car: what to keep in mind | Business ...

Buy vs Lease | Audi Roanoke. Car buyers have two financing options when it comes time to purchase a new car. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. What are the benefits of leasing a car? The contract discourages any customization. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. Consumer reports examines the basic differences: The company that finances your leased car owns it. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. Insurance coverages required by your lease holder. There are several distinct advantages to leasing versus buying. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. Leasing a car isn't for everyone. Comparing the two major finance choices.

Car Lease vs Buy Calculator

Lease vs Finance in Edmonton, AB | Sherwood Ford. Leasing a car isn't for everyone. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. Comparing the two major finance choices. Insurance coverages required by your lease holder. Consumer reports examines the basic differences: There are several distinct advantages to leasing versus buying. The company that finances your leased car owns it. The contract discourages any customization. What are the benefits of leasing a car? To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. Car buyers have two financing options when it comes time to purchase a new car. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be.

Lease VS Finance | Bolton Honda

Lease vs. Buying a Honda in Durham, NC | Crown Honda .... In fact, the finance company may require that you reverse any modifications prior to returning it, which can be. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. Consumer reports examines the basic differences: What are the benefits of leasing a car? There are several distinct advantages to leasing versus buying. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. The contract discourages any customization. Leasing a car isn't for everyone. At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. Car buyers have two financing options when it comes time to purchase a new car. Comparing the two major finance choices. Insurance coverages required by your lease holder. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. The company that finances your leased car owns it.

Buy vs Lease Car Calculator | Leasing vs Buying a Car ...

Lease vs Finance | South Oak Jeep Dodge Chrysler Ram. Fortunately, car leasing allows consumers to get behind the wheel of a new vehicle with a monthly when you finance a car, the lender holds the title to the vehicle until you pay off the loan. There are several distinct advantages to leasing versus buying. When leasing a car, customers are agreeing to make regular payments for a set period of time, often three or four years. Consumer reports examines the basic differences: Car buyers have two financing options when it comes time to purchase a new car. The contract discourages any customization. But it's attractive for those who want low initial payments and the ability to get a new vehicle every few years. The company that finances your leased car owns it. To help protect its financial interest in the car, the finance company will likely require you to carry collision coverage and. Comparing the two major finance choices. Insurance coverages required by your lease holder. What are the benefits of leasing a car? At the end, they return the car compared with financing the purchase of a new car, it will likely mean lower monthly payments for the same vehicle. Leasing a car isn't for everyone. In fact, the finance company may require that you reverse any modifications prior to returning it, which can be.